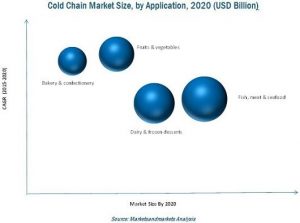

The report “Cold Chain Market by Type (Refrigerated Storage, Transport), Temperature Range (Chilled, Frozen), Technology (Air Blown, Eutectic), Application (Fruits & Vegetables, Bakery & Confectionery, Dairy, Meat, Fish & Seafood) & Region – Global Forecast to 2020″, is estimated to be valued at USD 167.24 Billion in 2015, and is projected to grow at a CAGR of 7.0% from 2015 to 2020, to reach a value of USD 234.49 Billion. The cold chain in the food & beverages industry has been in demand owing to the growth in international trade for perishable food products, changing consumer preferences, and government initiatives for cold chain infrastructure development. Cold chain service providers focus on adopting new technologies to cater to the increasing demand for food safety in processed and convenience foods. Hence, cold chain will be viewed as a business opportunity in the next five years. As a result, many multinational players have entered into providing cold chain solutions.

Target Audience:

- Cold chain service providers

- Third party logistics (3PL) providers

- Research institutions

- Raw material suppliers

- Cold chain solution providers

- Government bodies

- Distributors

- End-users (food industry)

Download PDF brochure to get more information@ http://www.marketsandmarkets.com/pdfdownload.asp?id=811

On the basis of application, the meat, fish & seafood segment is projected to dominate the cold chain market

The meat, fish & seafood segment has been estimated to lead the market in terms of value. The fruits & vegetables application segment of the global cold chain market is expected to grow at comparatively higher CAGR due to the rise in awareness of health products.

Frozen products are the most-widely consumed type of products

In 2014, the frozen segment accounted for the largest share in the cold chain market in terms of value. However, the chilled segment is projected to grow at comparatively higher CAGR due to the increasing demand for low temperatures at the time of storage, handling, distribution, retail display, and consumer storage.

Increasing health-consciousness among the consumers in developed and developing countries to boost the cold chain market

Countries in the Asia-Pacific, Latin American, and the Middle East regions are prospering in terms of the increasing usage of cold chain in the food industry. The rising population levels have also led to the rise in demand for processed and convenience foods, which is in turn driving the market for cold chain of perishable food products.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as Americold Logistics, LLC (U.S.), Preferred Freezer Services (U.S.), Burris Logistics (U.S.), Lineage Logistics Holdings, LLC (U.S.), and Nichirei Logistics Group Inc. (Japan).

About MarketsandMarkets

MarketsandMarkets is world’s No. 2 firm in terms of annually published premium market research reports. Serving 1700 global fortune enterprises with more than 1200 premium studies in a year, M&M is catering to multitude of clients across 8 different industrial verticals. We specialize in consulting assignments and business research across high growth markets, cutting edge technologies and newer applications. Our 850 fulltime analyst and SMEs at MarketsandMarkets are tracking global high growth markets following the “Growth Engagement Model – GEM”. The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write “Attack, avoid and defend” strategies, identify sources of incremental revenues for both the company and its competitors.

M&M’s flagship competitive intelligence and market research platform, “RT” connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets. The new included chapters on Methodology and Benchmarking presented with high quality analytical infographics in our reports gives complete visibility of how the numbers have been arrived and defend the accuracy of the numbers.

We at MarketsandMarkets are inspired to help our clients grow by providing apt business insight with our huge market intelligence repository.

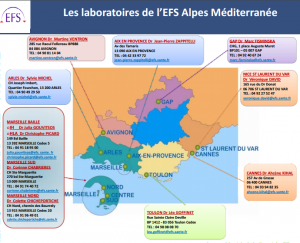

The EFS laboratory in Aix-en-Provence is a reception and distribution point of blood products that have been tested post-donation for pathogens and are ready to be used. In 2015, it processed 20,148 units of blood products (17,529 units of red blood cells; 1,148 units of platelets and 1,471 units of plasma) for the care of 3,759 patients.

The EFS laboratory in Aix-en-Provence is a reception and distribution point of blood products that have been tested post-donation for pathogens and are ready to be used. In 2015, it processed 20,148 units of blood products (17,529 units of red blood cells; 1,148 units of platelets and 1,471 units of plasma) for the care of 3,759 patients. Secondly, all units of blood products – platelets, red blood cells and plasma – are all kept in their own designated refrigerators. These all have a temperature indicator on their door, as well as an independent temperature monitor that is linked to an online map of all of the refrigerators in the laboratory, that is updated in real time with a full suite of data analytics.

Secondly, all units of blood products – platelets, red blood cells and plasma – are all kept in their own designated refrigerators. These all have a temperature indicator on their door, as well as an independent temperature monitor that is linked to an online map of all of the refrigerators in the laboratory, that is updated in real time with a full suite of data analytics. Also, all the bags of products in a group of bags are attached together with a self-locking cable tie that can only be removed by cutting it with pliers.

Also, all the bags of products in a group of bags are attached together with a self-locking cable tie that can only be removed by cutting it with pliers. Until we can determine that a suspect unit of product is safe to use, it’s placed in a quarantine refrigerator until its safety has been 100% confirmed. If this can be done, it then is moved to the appropriate refrigerator. If this cannot be done, it’s disposed of by means of incineration.

Until we can determine that a suspect unit of product is safe to use, it’s placed in a quarantine refrigerator until its safety has been 100% confirmed. If this can be done, it then is moved to the appropriate refrigerator. If this cannot be done, it’s disposed of by means of incineration. For plasma, the risk when the cold chain is breached is that the product will be altered very rapidly. Plasma is an extremely fragile product that must be used within six hours of being unfrozen.

For plasma, the risk when the cold chain is breached is that the product will be altered very rapidly. Plasma is an extremely fragile product that must be used within six hours of being unfrozen.